Tax Rules May Change for the Better at the Horse Track

Contributed By Dave "Daily Double" WildermuthPosted on 6/20/15 2:35 PM

The Triple Crown Winner American Pharoah brought a lot of attention to the sport of horse racing. It has been 37 years until Pharoah broke the Crown-less feat on June 6th 2015.

Horse racing and gambling go hand in hand. Who doesn't like to go to the track or bet on the internet for a possible pay day and bragging rights? Most of us can spend a few dollars at the track and feel ok with it going home win or lose. The issue hindering horse racing's growth has to do with winning bets.

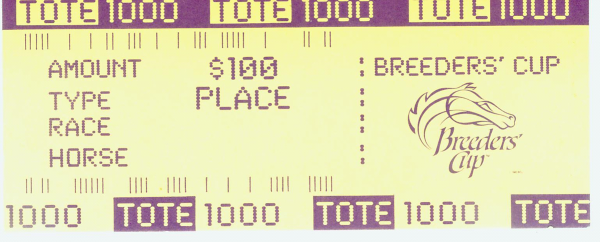

There are some Jurassic tax codes that tax winnings which exceed $5,000 or are 300 to 1 off your initial bet. (IE if you bet 2$, you can win as much as $600 before being effected by this old tax rule). This rule was fine and dandy when bets were straight forward with win, place, or show. However, with newer style wagering, such as a superfecta, you may have to pay taxes on ONE SINGLE $1 WAGER! Think of all of the extra work the race books have to go through handling all the tax implications for this.

What the NTRA wants to do is change simple wording to "amount wagered." This would free race books from ridiculous amounts of paperwork and allow winning bets to be paid in CASH so that earnings can be re-bet on the next race! (which would ultimately increase tax revenue).

If you have great organization skills and accounting abilities, you can itemize your return; writing-off winnings against any losses which you can prove! If the IRS and Department of Treasury make this adjustment, you will be able to instantly have access to your winnings! Let's hope that this change passes and strengthens the sport of horse racing!

comments powered by Disqus